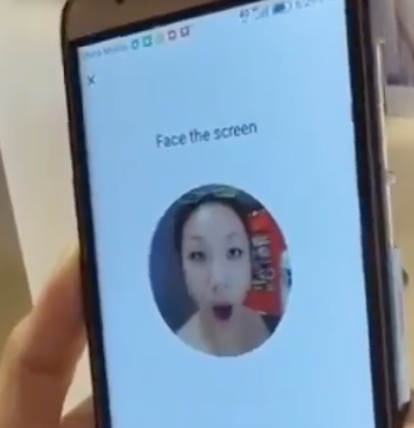

Watch this and consider the very real threat we face from the unelected bureaucrats who run the country/world and seek to influence and control our every move.

China. No digital ID no food.

— illuminatibot (@iluminatibot) May 12, 2024

This will 100% come to the EU and US pic.twitter.com/Vo0HFk7M5l

The advent of digital currencies in Western countries could potentially pave the way for a social credit system akin to China’s, albeit through indirect means. The riot on January 6 was a turning point in this regard, as it prompted major web companies to develop mechanisms that, in essence, could form the foundation of a “soft” social credit system by the end of the decade. This system, while not directly enforced by the government, could be leveraged through the influence of corporate America.

As the internet era continues to evolve, the role of Big Business in shaping societal norms and values is becoming increasingly significant. This influence is particularly evident in the push for social and political “correctness,” with companies taking on a more active role in monitoring and, to some extent, regulating the behavior of individuals through various means, including financial transactions and digital platforms. Another example is insurance companies, no placing cameras in cars to reward “good drivers” – how long before this is linked to the “safe-stop” technology currently being installed in new automobiles?

In addition, certain financial institutions and credit reporting companies are forming a powerful network that effectively manages anyone who comes in contact with money. This mechanism, in a broader sense, regulates people’s behavior and actions, aligning with the principles of a social credit system. As these corporations become more involved in the management of social and political behavior, they could effectively enforce a system of rewards and punishments, similar to China’s social credit system, albeit through a more subtle and indirect approach.

In this context, the role of digital currencies becomes crucial. As more countries adopt digital currencies, the potential for increased control and monitoring of financial transactions and behaviors grows. This could lead to a system where individuals’ social and political behaviors are closely tied to their financial and digital identities, with corporations playing a significant role in shaping and enforcing social norms and values.

It is essential, however, to approach this development with caution, ensuring that the introduction of digital currencies and the potential social credit system does not infringe upon individual rights and freedoms.

Trump says he won’t do it. Let us hope he means it.

HUGE

— PeterSweden (@PeterSweden7) November 9, 2024

Trump has promised to never allow the creation of Central Bank Digital Currency to protect people from government tyranny.

SHARE if you support this 👇pic.twitter.com/XstqSMmRUq